What Does "US Bank Mobile: The Convenient Way to Bank on the Go" Do?

US Bank Mobile is changing the means people bank today by providing its customers along with a convenient and dependable technique to handle their financial resources. With the increase of mobile phone consumption, US Bank has realized the increasing need for customers to possess access to their profiles on-the-go. In this post, we are going to look into some of the features that help make US Bank Mobile stand up out and why it is ending up being a go-to choice for many consumers.

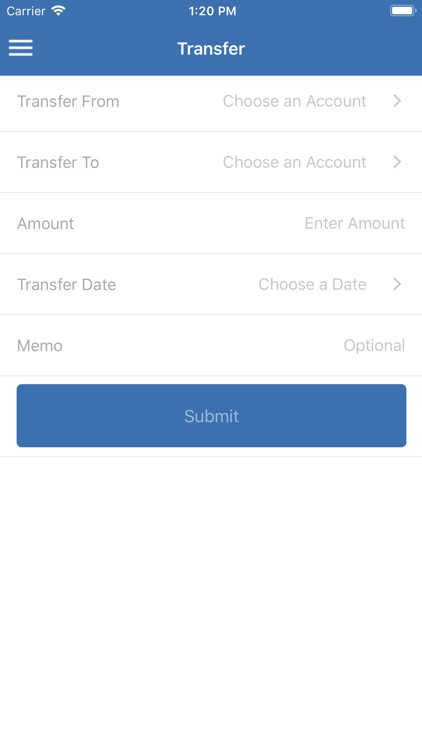

One of the very most notable attribute of US Bank Mobile is its potential to execute essentially all banking deals through a client's smartphone or tablet computer gadget. Customers can easily see profile harmonies, transfer funds between accounts, wages expenses, and also deposit inspections using their mobile phone units. This implies that consumers no a lot longer possess to physically visit a division or ATM to finish these transactions, saving time and making banking a lot more practical.

One more key component of US Bank Mobile is its safety and security procedure. The application requires users to authenticate themselves making use of either Touch ID or Face ID (depending on their gadget) prior to getting access to their accounts. This guarantees that just accredited individuals may access sensitive financial relevant information.

In add-on, US Bank Mobile also uses real-time alerts that alert customers when particular purchases happen on their profile. For instance, if there is actually an unapproved purchase or if a balance falls listed below a pointed out amount, an notification will definitely be sent out instantly to the consumer's gadget. This aids make certain that customers are aware of any prospective deceitful activity on their account as very soon as possible.

US Bank Mobile likewise makes it possible for for simple budgeting and financial program with its Money Manager attribute. Consumers can easily categorize their investing behaviors and prepared spending plans for various classifications such as entertainment or groceries. The application then tracks spending in each classification and supplies alarm when the spending plan restriction has been got to.

Moreover, US Bank Mobile delivers personalized ideas in to a customer's spending habits by means of its Spend Analysis resource. This tool analyzes purchase history and gives understandings in to where cash is being invested each month. This feature assists consumers pinpoint areas where they might be overspending and create changes to their spending plan as needed.

US Bank Mobile is likewise integrated along with Apple Pay, Samsung Pay, and Google Pay. This suggests that consumers may utilize their smartphones or smartwatches to produce investments at participating stores without possessing to hold a bodily credit report or debit card.

Eventually, US Bank Mobile supplies a component contacted My Private Bank, which makes it possible for customers to hook up along with a personal lender by means of the application. Customers can ask questions regarding their accounts or obtain financial insight from a experienced professional.

In final thought, US Bank Mobile is modifying the way people bank today by supplying consumers along with a hassle-free and safe means to deal with their finances. With Click Here For Additional Info as real-time warning, budgeting devices, and tailored knowledge right into spending behaviors, US Bank Mobile is becoming an significantly preferred option for those who value convenience and efficiency in their banking experience. As mobile consumption proceeds to increase, it is most likely that even more banking companies will definitely observe fit and use identical companies in order to fulfill the progressing requirements of consumers.